We can show them the direct correlation between not buying something minimal, to save and make a bigger impact later. It’s easier for us to explain money to our kids now that we know where it’s all going. And your kids will notice the change too.

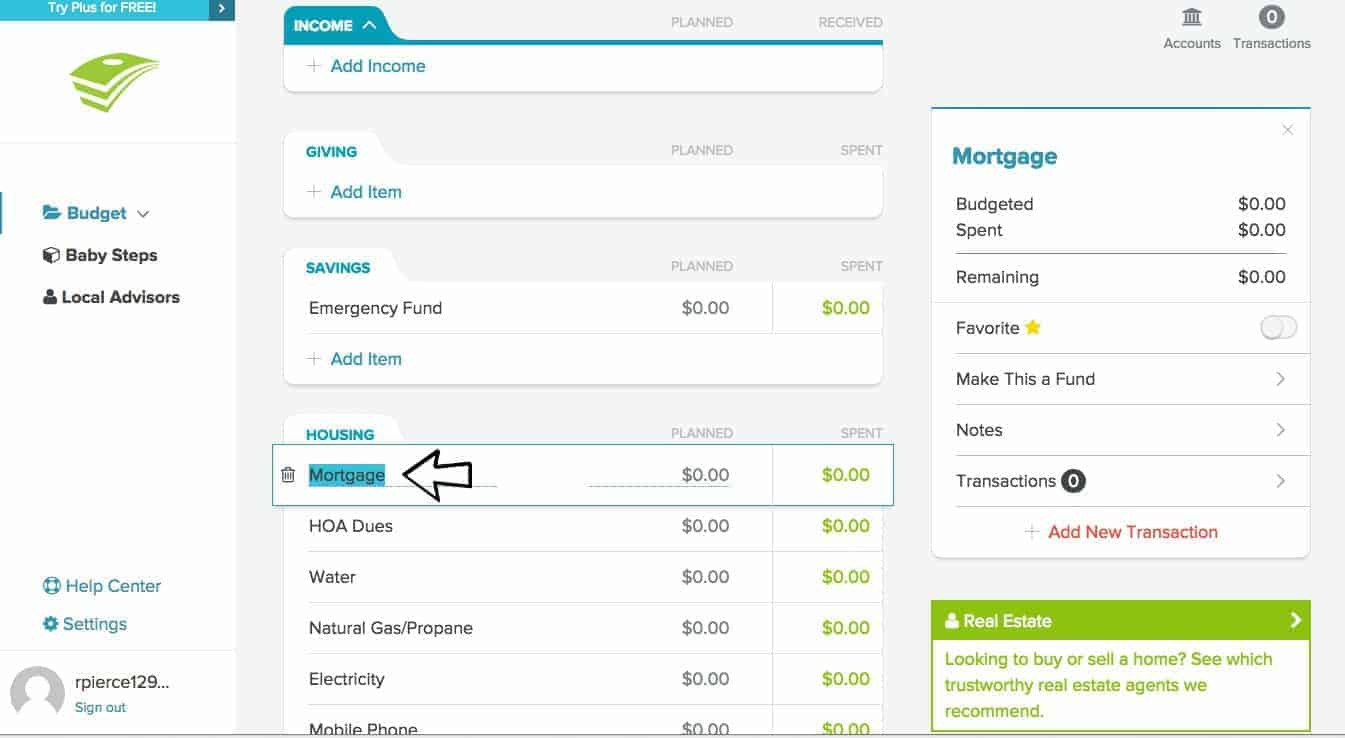

Once you save enough with a budget to pay off that debt hanging around your neck or donate to a charity close to your heart, you’ll be hooked. Tracking your money and living within a budget aren’t easy skills to master, but so worthwhile. Our bank account (and our bodies) has appreciated this change. We knew once we hit that certain amount, we were done buying junk at the gas stations. So for the next month, we budgeted an amount that was far less than we were spending. This was a category we very much wanted to change after we saw its impact. You’ll also be able to analyze which categories you’re spending the most in and determine if that’s really where you want your money to go.įor us, our surprise spending category was, embarrassingly enough, “gas station food and drinks.” While we knew we stopped occasionally to get a pop, snack, and slushy for the kids, we never would have guessed how those purchases added up. After you’re done, you’ll be able to see if you are living within your means if you’re spending less than you’re making. You’ll enter every purchase you make into the app under categories you choose, for that month or two. To start getting in touch with your money and finding out where every dollar goes, track your normal spending for a month or two. Once you’re in control, your budget can be as strict or not strict as you want it to be. And while budgeting gets a bad rap because it’s associated with extreme frugality and saying no to brand-name coffee and going out to eat, that isn’t what it has to be. I’m talking about every dollar and cent that you see come into your bank account, do you know where it goes? If not, it may be time to start a budget. To determine if this app or budgeting, in general, is something you should consider, first answer this question: do you know where every dollar you make goes? Side note: this isn’t an ad for the app, it’s just a tool we wanted to share that has served our family well in making smarter spending decisions and paying off debt. This has definitely been the case in our family, which is why we started using the EveryDollar budgeting app by Dave Ramsey. Without a plan, our money gets spent without us even recognizing it or acknowledging where it’s going. Money can’t buy happiness, or can it? It’s a taboo conversation starter for sure, but one we should think through to help us determine what role money plays in our lives and how we can manage it better. EveryDollar Budgeting App – Is it for your family?

0 kommentar(er)

0 kommentar(er)